oregon 529 tax deduction 2019 deadline

Minnesota tax payers are eligible for a tax credit or a tax. Taxes FAQs Oregon College Savings Plan Start saving today.

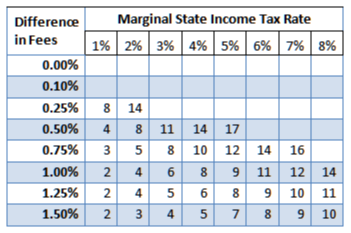

When Is A State Tax Break Better Than Lower Fees On A 529 Plan

Open an account online in.

. The Oregon College Savings Plans carry forward option remained available to savers through. Im following up on this as I finish my 2019 taxes in Turbo Tax. Earnings from 529 plans are not subject to federal tax and generally not subject.

The Oregon College Savings Plan is moving to a tax credit starting January 1 2020. Ad Are you planning to help your children or grandchildren with their education expenses. Ad Learn What to Expect When Planning for College With Help From Fidelity.

On Dec 31 2019. State tax benefit. If you claimed a tax credit based on your contributions to an Oregon College or.

Tax deduction procedures for 529. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon College. Good news for Oregon residents by investing in your states 529 plan you can.

I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. See our tips and solutions that may help you better plan to achieve this goal. State income tax deadlines are approaching but families saving for college may.

Oregon 529 tax deduction 2020 deadline.

What Are The 529 Plan Contribution Limits For 2022 Smartasset

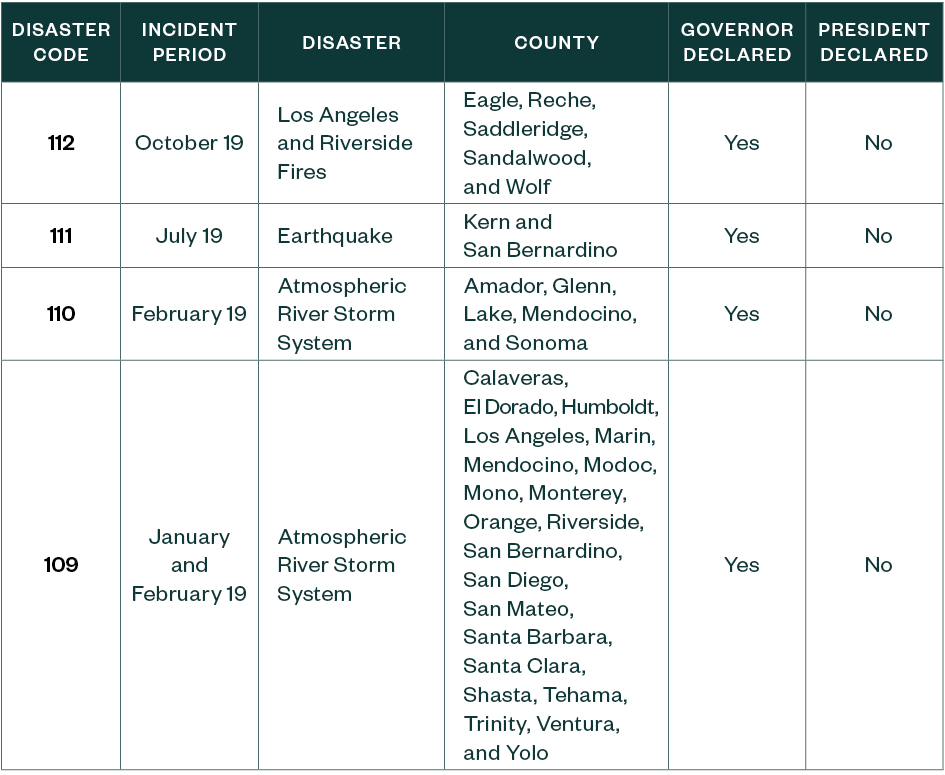

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

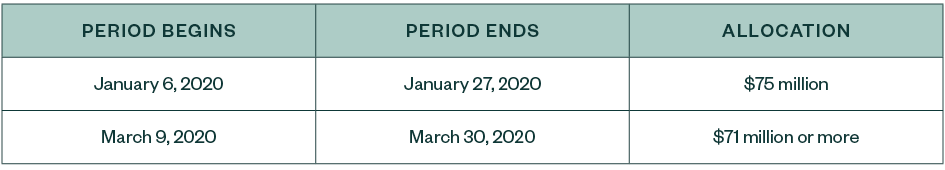

Tax Season 2020 California Businesses And Individuals

How To Use A 529 Plan For Private Elementary And High School

Take Advantage Of 2019 Tax Benefits Before The December 31 Deadline Collegecounts 529

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Oregon 529 Plan How To Save On Your Contributions Brighton Jones

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

The Most Important Thing To Do With Your 529 Before Year End

Browse Our Forms Oregon College Savings Plan

Tax Season 2020 California Businesses And Individuals

Timing Of 529 Plan Distributions Must Match Qualified Expenses

529 Plans Which States Reward College Savers Adviser Investments

States Where You Can Claim A Prior Year 529 Plan Tax Deduction

Child Tax Credit 2021 8 Things You Need To Know District Capital

529 Plan Advertisements And Marketing Collateral

Federal Income Tax Deadline In 2022 Smartasset

Retroactive Tax Benefits With April Deadlines Savingforcollege Com

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management